A data-backed look at zero-slippage liquidity across 28,737 transactions

Key Takeaways

- An analysis of 28,737 transactions shows Bolt consistently delivering better execution than AMM-based DEX routing.

- Bolt demonstrates a clear structural advantage that becomes more pronounced as swap sizes increase.

- Across major asset pairs, Bolt produced a positive percentage advantage and a clear win-rate lead.

- These results validate Bolt’s liquidity model as an execution layer capable of outperforming depth-based pricing systems across ecosystems.

This case study uses Cosmos as the data source, but the findings reflect structural properties of AMM routing vs. zero-slippage execution. The conclusions apply broadly across ecosystems.

Overview

Most decentralized exchanges rely on AMMs whose pricing depends on pool depth, curve mechanics, and liquidity distribution. Even with advanced routing, these systems inherit several constraints:

- price impact rises exponentially with size

- liquidity fragmentation reduces efficiency

- external markets move faster than pools update or rebalance

- routing optimizes within the ecosystem, not across global liquidity

Bolt approaches execution from a different angle. Its zero-slippage model uses unified, cross-chain price aggregation rather than curve-based pricing. This means execution quality doesn’t degrade as trades get larger, and Bolt can reflect external market liquidity more effectively than traditional AMM-based systems.

To evaluate this difference in practice, we ran a large-scale comparison using 28,737 matched transactions across Cosmos routing pathways vs. the same transactions executed through Bolt.

The goal wasn’t to evaluate specific DEXs or aggregators.

The goal was to test the architecture: Does Bolt's zero-slippage model outperform traditional AMM routing in real conditions?

The data says yes. Consistently.

Bolt outperforms traditional DEX routing across almost every asset pair and improves as swap size scales.

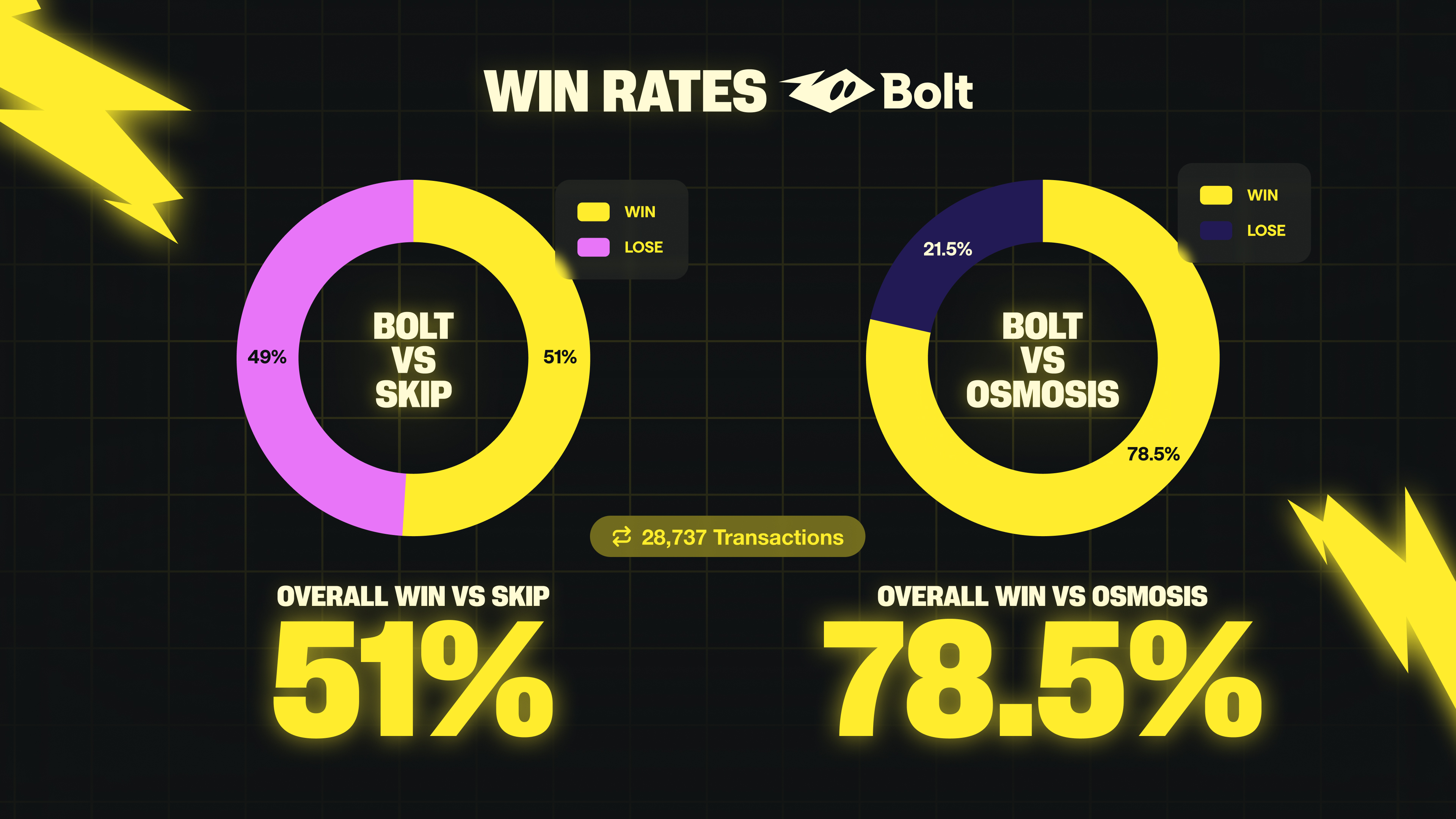

Head-to-Head Win Rates

Across 28,737 matched transactions:

- Bolt delivered better execution 78.5% of the time relative to Osmosis’s AMM routing.

- Against Skip’s sophisticated routing engines, Bolt still achieved a 51% win rate.

This means that when all venues are given the same orderflow:

- Bolt delivers better execution nearly 4 out of every 5 times vs Osmosis

- Bolt is effectively tied with Skip, yet still edges out the majority of transactions

For dApp builders, this distinction matters: Bolt doesn’t replace aggregators — it strengthens them.

Integrators gain a strictly better execution profile without changing UX or giving up atomicity.

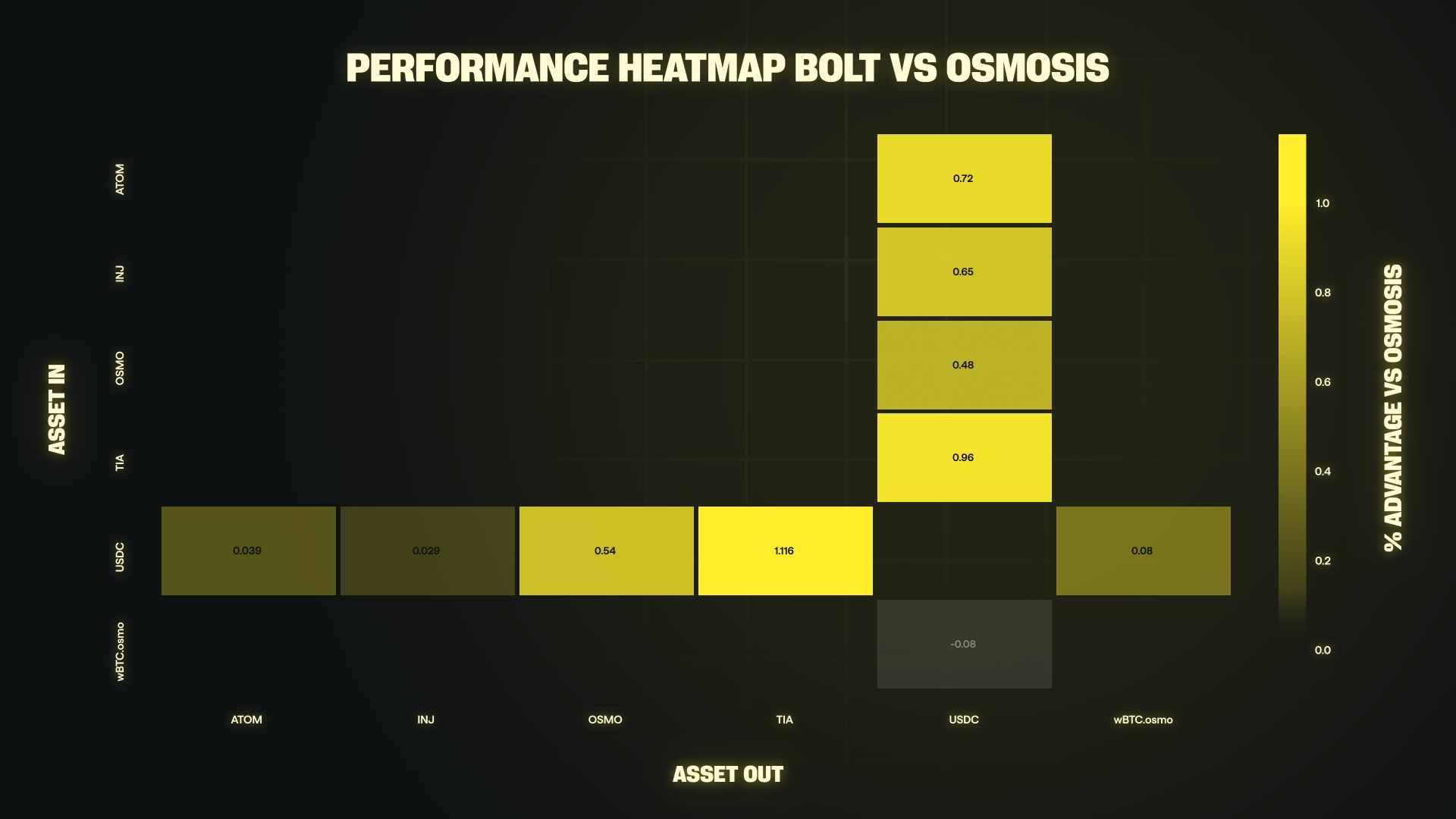

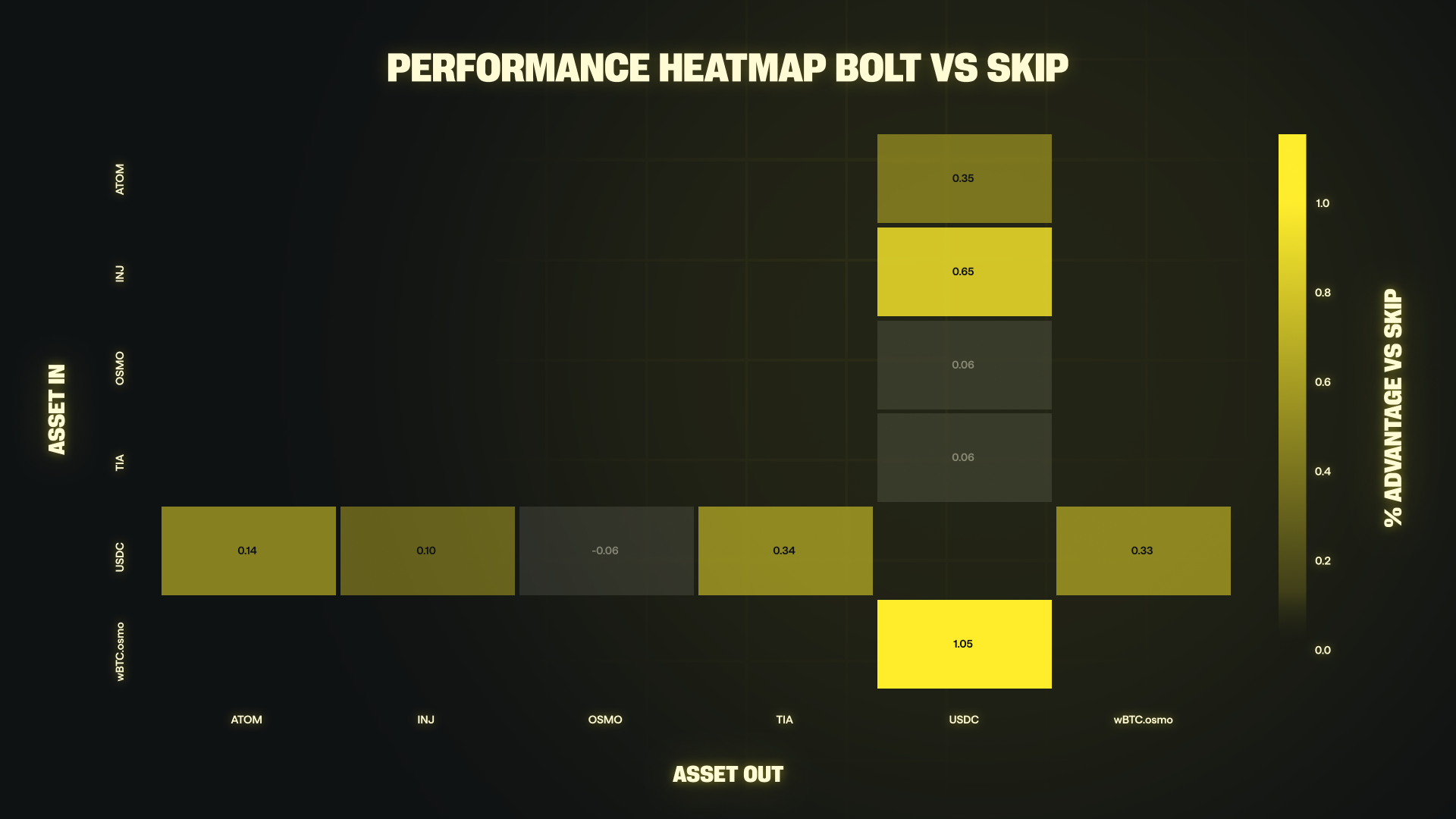

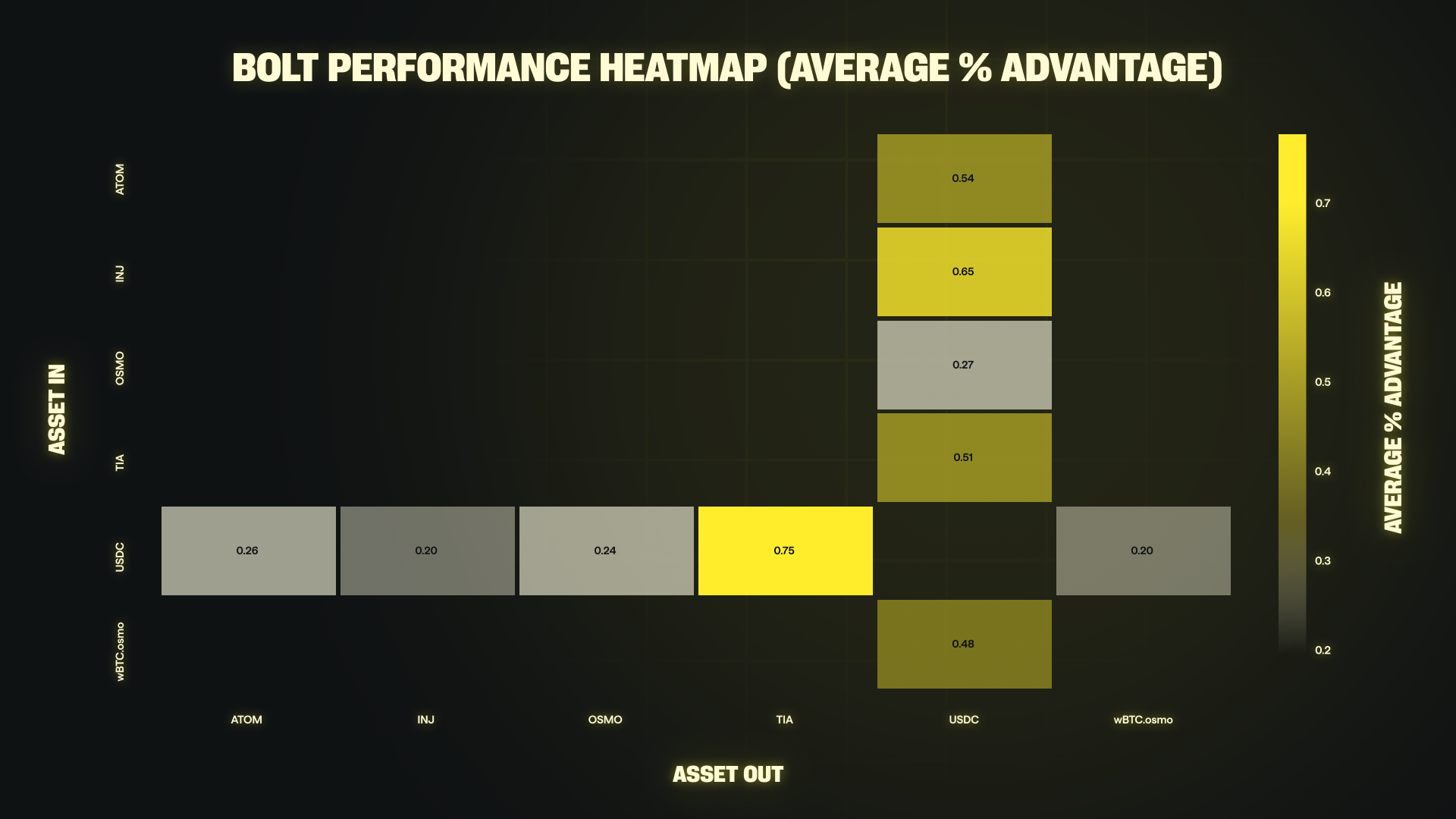

Performance Across Asset Pairs

Across nearly every major trading corridor tested, Bolt delivered a positive percentage advantage.

Even in corridors where AMMs typically exhibit stronger depth, Bolt maintained competitive or superior performance.

Aggregating across all pairs yields a clear picture:

Bolt’s model produced a net positive average advantage across the dataset, reinforcing that the benefit is structural rather than limited to specific pairs or isolated market windows.

Swap Size: Structural Advantages at Scale

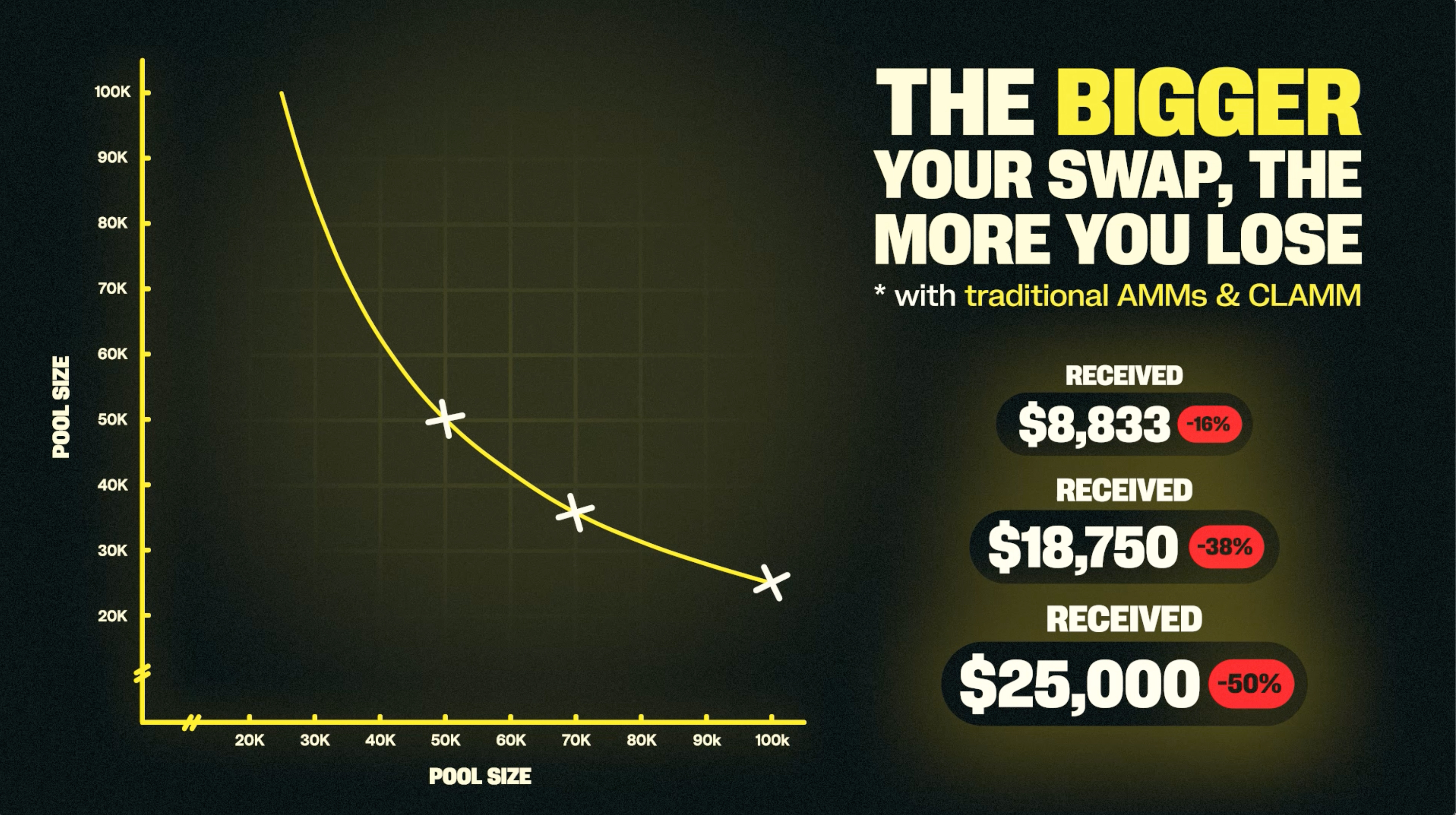

AMMs inherently suffer from size-dependent price impact. Even deep pools curve sharply as trade size increases.

Bolt’s execution layer does not.

This difference becomes clear when analyzing scatter plots across swap sizes:

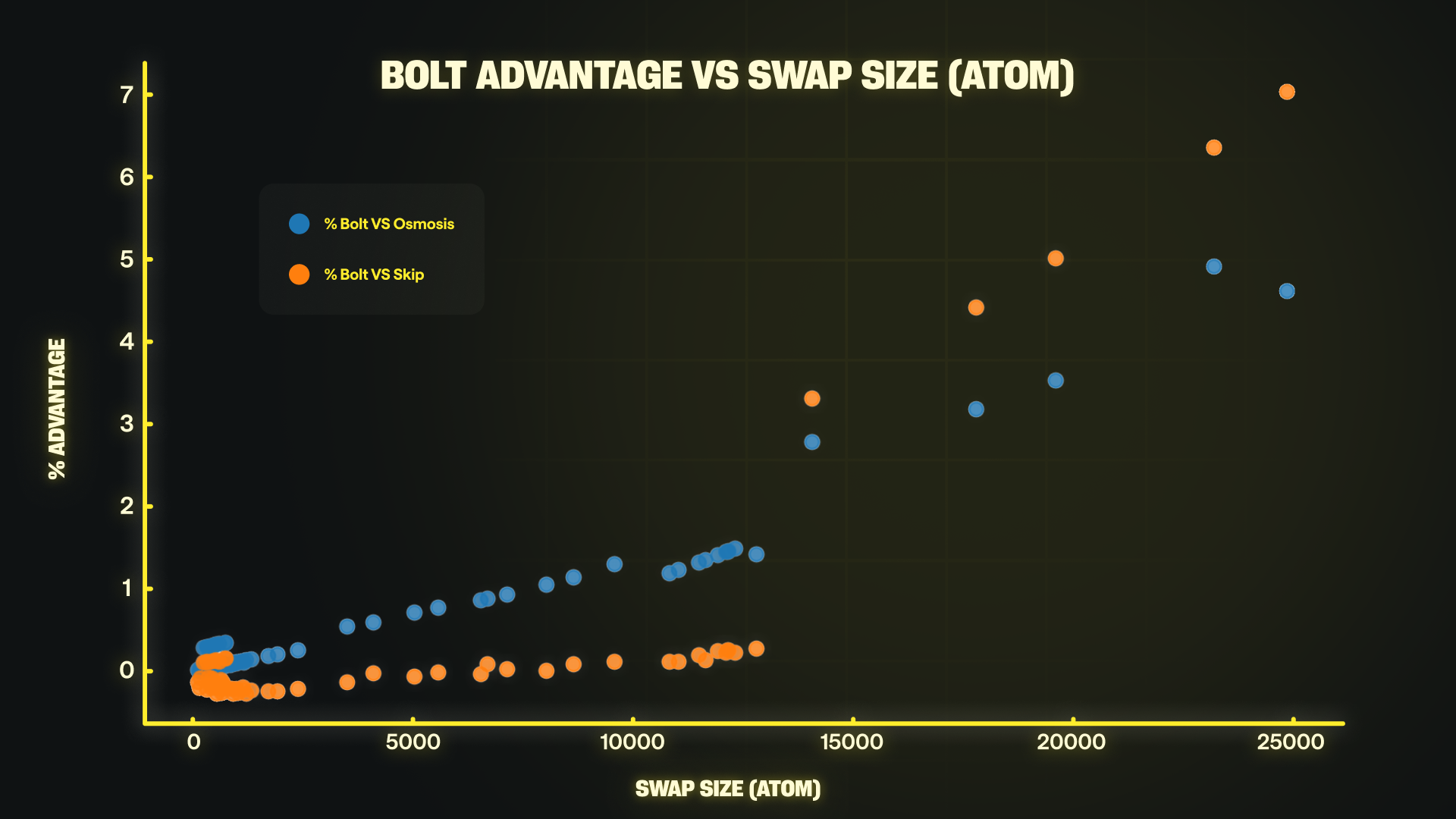

ATOM Swap Sizes

For ATOM:

- Small swaps: Bolt holds a steady advantage

- Large swaps: advantage rises into the 3–5%+ range

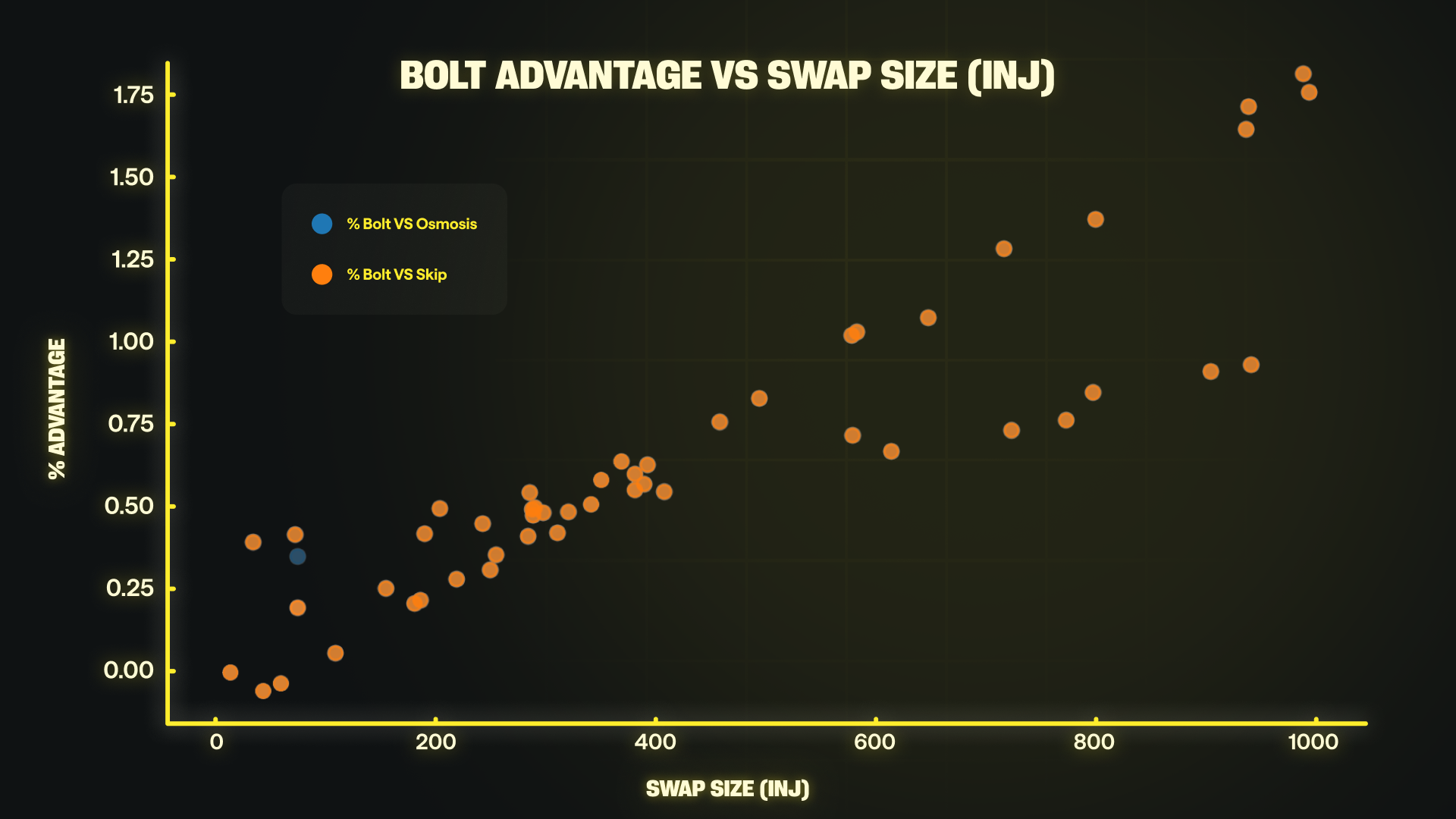

INJ Swap Sizes

INJ shows a similar pattern:

- Bolt maintains a steady advantage across mid-sized trades.

- For larger INJ sizes, the advantage reaches 1.75% or more.

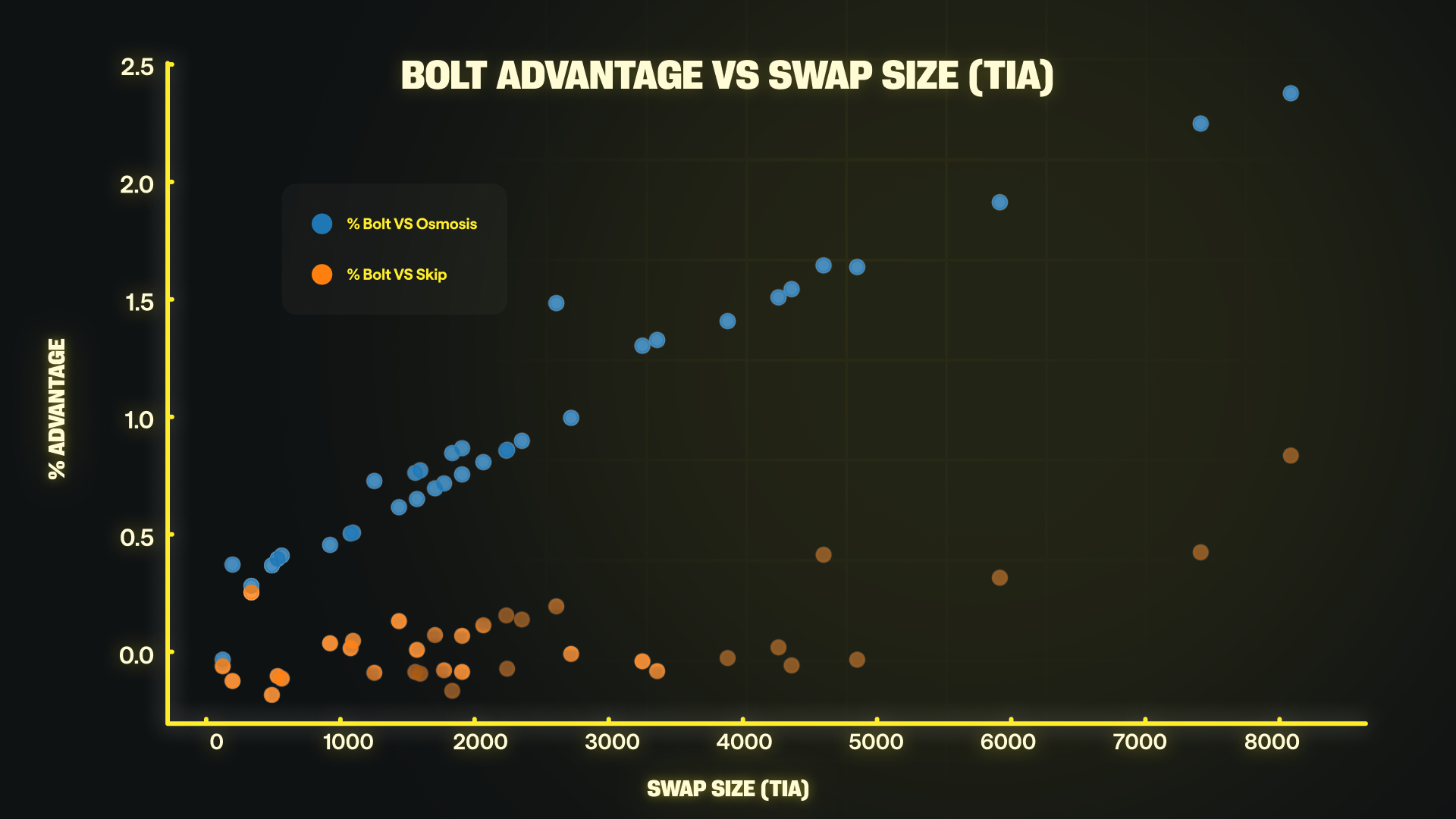

TIA Swap Sizes

With TIA, Bolt’s structural edge becomes even clearer:

- As swaps reach thousands of TIA, Bolt’s advantage grows sharply.

- Large-size trades saw Bolt outperform AMM routing by 2%+ or more.

Across all assets, the trend is the same: AMM slippage scales with size. Bolt’s model doesn’t.

This is why the performance gap widens: the architectural constraints diverge as trade size grows.

Why Bolt Wins: A Technical Perspective

This case study is not a comparison of specific DEXs or aggregators; rather, it demonstrates how two liquidity models perform in production conditions.

1. Zero-Slippage Pricing

AMMs expose users to curve pricing and depth limitations.

Bolt does not. Execution is sourced from a unified liquidity model that avoids:

- curve-based decay

- pool fragmentation

- size-based penalties

2. External Price Aggregation

Bolt aggregates prices across global liquidity, not just local pools.

This gives Bolt access to market conditions that AMMs cannot reflect in real time.

3. Atomic Execution and Composability

Unlike RFQs, off-chain intents, or whitelist-based routing systems, Bolt maintains:

- atomicity

- deterministic settlement

- smart contract composability

4. A Liquidity Model That Scales

AMM routing becomes more expensive as size increases.

Bolt remains stable. Its performance curve is effectively flat.

This study shows the results of those structural differences when applied to real userflow at scale.

Implications for Builders Across Ecosystems

Although this dataset is Cosmos-specific, the architectural dynamics apply everywhere:

- AMMs fragment liquidity across chains, pools, and fee tiers

- Market makers must manually mirror prices

- Curves introduce unavoidable price impact

- Multi-hop routing amplifies losses

For builders, this case study demonstrates two simple truths:

1. When execution depends on depth-based pricing, there is a ceiling.

2. When execution depends on global price aggregation, that ceiling disappears.

What Integrators Gain

For wallets, dApps, aggregators, and foundations evaluating execution layers:

- Better user outcomes

- More predictable execution for large size

- No need to manage fragmented liquidity

- Full composability and atomicity

- A competitive edge for power users and institutions

Bolt integrates cleanly into existing systems, improving execution without requiring a change in user-facing UX.

Conclusion

Across 28,737 real transactions, Bolt consistently delivered better execution than the Cosmos ecosystem’s most established routing paths. Heatmaps, scatter plots, and win-rate analysis all point to the same conclusion:

Bolt's zero-slippage execution is structurally stronger than AMM-based routing, especially as size grows and markets move.

Bolt isn’t a replacement for the ecosystem’s existing liquidity infrastructure.

It’s the next layer—a performance multiplier that slots cleanly into aggregators and dApps to produce better outcomes at every scale.

As we deploy more Bolt Outposts across additional chains, we expect this performance story to compound: execution quality that scales with orderflow, not against it.

Join the Movement

Bolt is more than a protocol launch — it’s a rallying cry for builders, LPs, traders, and believers to unite around a stronger DeFi ecosystem. The multichain era demands a truly efficient liquidity layer, and Bolt is here to deliver.

.png)